In a competitive construction market, customer financing is an undervalued asset for contractor businesses. By offering flexible payment options tailored to client needs, contractors can secure more projects, build relationships, and address cash flow issues. Implementing this strategy positions them as forward-thinking service providers, unlocking new growth opportunities and expanding business reach. Key practices include flexible payment plans, integrated financing options, user-friendly platforms, active promotion, favorable rates via partnerships, and staying updated on industry trends.

Looking to expand your contractor business? Consider the power of customer financing. This strategy can unlock new growth opportunities by meeting client needs beyond traditional services.

This article guides you through understanding and implementing various financing options tailored for contractors, from short-term loans to payment plans. We’ll explore best practices to ensure success, empowering you to cater to a wider customer base and drive sustainable business growth through effective customer financing for contractors.

- Understanding Customer Financing for Contractors

- Implementing Financing Options in Your Business Strategy

- Best Practices and Tips for Success with Contractor Financing

Understanding Customer Financing for Contractors

Many contractor businesses overlook a powerful tool that can significantly boost their growth potential: customer financing. In today’s competitive market, offering flexible financing options to clients is an effective strategy to stand out and secure more projects. By understanding the financial needs of your target audience, you can create customized solutions, making your services more appealing and accessible.

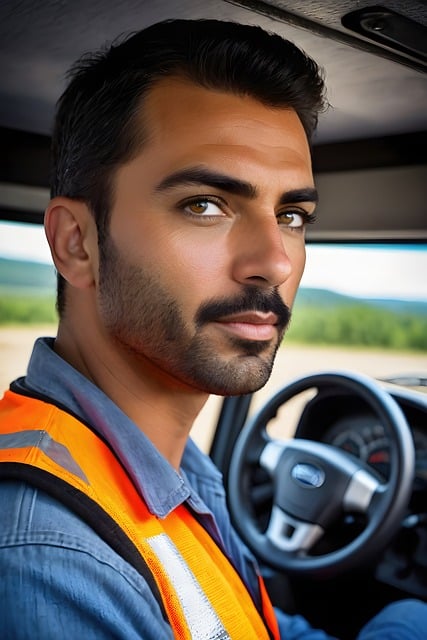

Contractors often face challenges when it comes to securing large-scale projects due to cash flow constraints or lack of creditworthiness perceived by clients. Providing customer financing bridges this gap, allowing contractors to offer competitive bids without the immediate financial burden on clients. This approach fosters trust, strengthens client relationships, and encourages repeat business. With the right financing structure, contractors can unlock new opportunities, expand their reach, and solidify their position in the market as reliable and forward-thinking service providers.

Implementing Financing Options in Your Business Strategy

Implementing customer financing for contractors can be a powerful strategy to expand your business and attract a broader client base. It provides an opportunity to offer flexible payment terms, making your services more accessible and appealing to potential customers. By partnering with financial institutions or utilizing in-house financing options, you can streamline the process, ensuring a seamless experience for both yourself and your clients.

This approach not only boosts customer satisfaction but also opens doors to new project opportunities. It allows contractors to take on larger-scale jobs that might have been previously out of reach due to payment constraints. With the right financing structure in place, you can position your business as a preferred choice for clients seeking both quality craftsmanship and flexible financial solutions.

Best Practices and Tips for Success with Contractor Financing

Best Practices and Tips for Success with Customer Financing for Contractors

Implementing customer financing for your contractor business can be a powerful strategy to stand out in a competitive market and drive growth. Start by offering flexible payment plans that cater to different client needs, whether they prefer spread-out payments or immediate discounts. Seamless integration of financing options into your sales process is key; ensure your team is well-trained to present these options effectively to potential customers. A user-friendly online platform for managing customer profiles and loan applications can streamline the entire process, enhancing both customer satisfaction and your operational efficiency.

Promote your financing services actively through targeted marketing campaigns. Highlighting the benefits of spread-out payments can attract clients who value budget planning and cash flow management. Building strong relationships with financial institutions or lenders is also vital for securing competitive rates and terms, which you can then pass on to your customers. Lastly, stay updated on industry trends and adjust your financing models accordingly; this dynamic approach will ensure your business remains a go-to option for customer financing for contractors.

By integrating customer financing for contractors into your business strategy, you unlock a powerful growth tool. It enhances customer satisfaction, opens access to larger projects, and fosters long-term relationships. Implementing these financing options effectively, combined with best practices outlined in this article, can significantly boost your contractor business’s success and market competitiveness. Remember, understanding your customers’ needs and offering flexible payment solutions are key to thriving in the industry.