Contractor financing fees are vital costs covering application, risk assessment, underwriting, and loan management services. Understanding these fees is crucial for informed financial decisions by contractors. Loan options include traditional bank loans and alternative lenders with varying terms and rates. Interest rates, influenced by loan amount, duration, and creditworthiness, can differ widely between lenders. Comparing offers from multiple specialized lenders helps secure favorable terms. Loan origination charges, which vary based on lender, loan amount, and type, significantly impact a contractor's bottom line. Transparent communication and negotiating interest rates based on creditworthiness or track record can lead to more cost-effective loans for contractors.

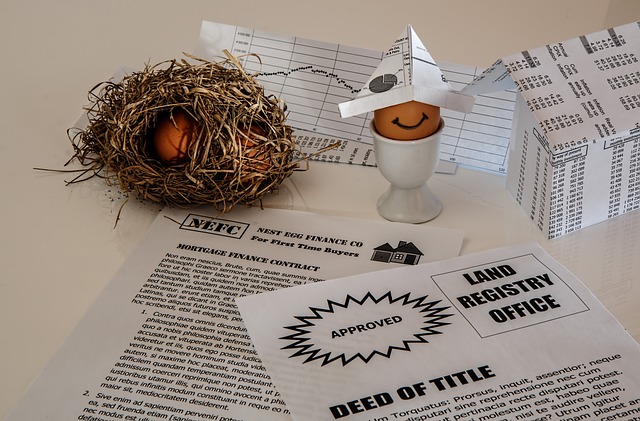

Estimating contractor financing fees is a crucial step before securing any construction project. This guide delves into the intricacies of understanding, navigating, and negotiating these charges, which can significantly impact your budget. From exploring types of loans available for contractors—such as short-term hard money loans and longer-term bank financing—to calculating interest rates and loan origination fees, this article equips you with essential knowledge to make informed decisions in the world of contractor financing.

- Understanding Contractor Financing Fees

- Types of Loans Available for Contractors

- Calculating Interest Rates and Charges

- Factoring in Loan Origination Fees

- Tips for Negotiating Better Terms

Understanding Contractor Financing Fees

Contractor financing fees are charges associated with obtaining loans for contractors, and they play a significant role in the construction industry. These fees represent the cost of doing business and can vary widely depending on several factors. Understanding these fees is essential for contractors, as it helps them budget effectively and make informed decisions regarding their projects’ financial aspects.

When considering loans for contractors, these fees cover various services, including processing applications, assessing risks, underwriting, and managing the loan throughout its lifecycle. They are typically expressed as a percentage of the loan amount or as a fixed rate, sometimes including additional costs like origination fees and closing costs. By grasping how these financing fees operate, contractors can better navigate the lending process, negotiate terms, and manage their project finances more efficiently.

Types of Loans Available for Contractors

Contractors have several loan options available to fund their projects, each with its own set of advantages and requirements. Traditional banks offer a range of financing solutions, including commercial loans, which are suitable for established contractors seeking long-term funding. These loans often require collateral and strict repayment terms but can provide steady, predictable finances over the life of the project.

Alternative lenders, such as online platforms or specialized financial institutions, have gained popularity in recent years. These entities provide faster approval times and more flexible terms, including short-term loans or lines of credit. While they may offer convenience, they could also come with higher interest rates and less favorable conditions. Contractors should carefully consider their financial needs and explore different loan types to secure the most beneficial financing for their ventures.

Calculating Interest Rates and Charges

When estimating contactor financing fees, calculating interest rates and charges is a critical step. Lenders often apply various factors to determine the interest rate for loans for contractors, such as the loan amount, duration, and creditworthiness of the borrower. Understanding these elements is key to gauging potential financing costs.

Remember that interest rates can significantly impact the overall cost of borrowing. Different lenders may offer varying rates based on their risk assessment and market conditions. Therefore, it’s advisable for contractors to shop around and compare offers from multiple lenders to secure the best terms for their loans for contractors.

Factoring in Loan Origination Fees

When evaluating contactor financing fees, it’s crucial to consider loan origination charges, a key component in the overall cost of contractor loans. These fees represent the expense involved in processing and setting up a construction loan. For contractors, understanding these fees is essential as they directly impact the bottom line of any project. Loan origination fees can vary widely depending on several factors, including the lender, loan amount, and type of financing.

For instance, when contractors secure loans for contractors, these fees could range from a percentage of the loan value to a fixed sum. Lenders may charge these fees upfront or incorporate them into the overall interest rate structure. To stay competitive in the market, contractors should shop around for lenders who offer transparent and reasonable origination fees, ensuring cost-effectiveness for their projects without compromising on quality financing options.

Tips for Negotiating Better Terms

When negotiating terms with lenders for contractor financing, there are several strategies to consider. Firstly, understand that communication is key; express your needs clearly and respectfully. Contractors often have unique financial situations, so be prepared to share details about your business history and projected growth. This transparency can help build a strong relationship with lenders, increasing the likelihood of securing favorable terms.

Additionally, do your research on different loan options available for contractors. Explore various lenders, compare interest rates, and look for any hidden fees. Being well-informed enables you to make strategic choices and ask for adjustments where needed. Consider negotiating the interest rate, especially if you have excellent credit or a solid track record as a contractor. Lenders may be open to offering better rates to secure your business, making your loans for contractors more cost-effective.

When considering loans for contractors, understanding the various financing fees is crucial. By grasping the different types of available loans, calculating interest rates and charges, factoring in origination fees, and employing negotiation strategies, you can navigate the process effectively. These insights empower contractors to secure favorable terms, ensuring financial stability and successful project completion. Remember that savvy financiers are best equipped to manage their cash flow and capital requirements.