Contractor loans (construction financing) provide essential capital for building and renovation professionals, managing cash flow during projects. This tailored funding offers flexible terms, allowing businesses to focus on core competencies while lenders handle financial complexities. The process involves application assessment, project-tied disbursement, and repayment with potential better loan terms in the future. Ideal for seasonal work or unpredictable projects, these short-term solutions have higher interest rates but stringent eligibility criteria.

In today’s competitive market, contractors are increasingly turning to contractor loans to unlock financial opportunities. This article delves into the world of contractor financing, offering a comprehensive guide on how these loans work and their numerous benefits. We’ll walk you through the process step-by-step, highlighting considerations for contractors looking to leverage this powerful tool. Discover how contractor loans can propel your business forward while managing cash flow effectively.

- Understanding Contractor Loans: Unlocking Financial Opportunities

- How Contractor Financing Works: A Step-by-Step Guide

- Benefits and Considerations for Contractors Using Loans

Understanding Contractor Loans: Unlocking Financial Opportunities

Contractor loans, also known as construction financing, are a crucial tool for professionals in the building and renovation industry. These loans are designed to provide contractors with the financial resources needed to undertake projects, ensuring they have the capital to purchase materials, hire labor, and manage other associated costs. Understanding contractor loans can open up a world of opportunities for both established and emerging contractors.

By securing financing specifically tailored to their trade, contractors gain access to funds that support their operations and enable them to take on more diverse projects. These loans often come with flexible terms, allowing businesses to manage cash flow effectively during different stages of construction. With contractor loans, professionals can focus on what they do best—building and transforming spaces—while leaving the financial complexities to specialized lenders who understand the unique needs of this sector.

How Contractor Financing Works: A Step-by-Step Guide

When it comes to funding your construction project, contractor financing through loans can be a game-changer. Here’s how it typically works:

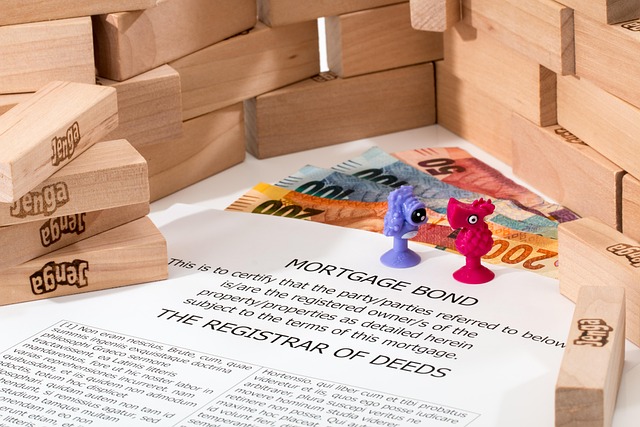

1. Assessment and Planning: First, contractors evaluate the project scope and financial requirements. They determine the type and amount of contractor loans needed to cover costs like materials, labor, permits, and contingencies. This step is crucial for ensuring you secure adequate funding without over-borrowing.

2. Loan Application and Approval: Next, the contractor submits a loan application to a financing institution or lender. This involves providing detailed project plans, financial projections, and sometimes personal or business financial statements. After reviewing these documents, the lender assesses the risk and decides whether to approve the loan request. Fast-track lenders may offer quicker approvals, while traditional banks might take longer but often provide more favorable terms.

3. Loan Disbursement: Once approved, the lender releases the funds according to the agreed-upon terms. Contractor loans can be disbursed in a single lump sum or through progressive payments tied to specific project milestones, ensuring funding aligns with work completion.

4. Repayment: After project completion and revenue generation, contractors begin repaying the loan with interest. Repayment plans vary; some lenders offer fixed rates, while others may have variables tied to market conditions. Timely repayment demonstrates responsible financial management and can open doors for future contractor loans with more favorable terms.

Benefits and Considerations for Contractors Using Loans

For contractors, accessing capital through contractor loans can present a multitude of benefits. These short-term financing options are tailored to meet the cash flow needs of self-employed individuals and small businesses involved in construction projects. The primary advantage lies in their flexibility; contractors can borrow only the funds required for specific jobs, avoiding the burden of long-term debt with fixed monthly payments. This is particularly beneficial for seasonal work or projects with unpredictable timelines.

However, there are considerations to keep in mind. Interest rates on contractor loans can be higher compared to traditional banking options, reflecting the increased risk associated with short-term lending. Additionally, lenders may have stringent eligibility criteria based on factors like credit history and project scope, making it crucial for contractors to carefully evaluate their financial situation and project prospects before applying.

Contractor loans present a powerful tool for professionals in the construction industry, offering flexible financing options to fund projects and expand their business. By understanding the various loan types, repayment terms, and potential benefits, contractors can make informed decisions to unlock financial opportunities, streamline cash flow, and drive growth. Embracing contractor financing is a strategic move that can propel businesses towards success in today’s competitive market.