Contractor loans are specialized financial products designed to meet the unique cash flow challenges faced by construction professionals. These loans offer flexible funding tailored to cover project-related expenses, including materials and labor costs. They are structured to align with the cyclical nature of construction work, providing repayment terms that adapt to the ebb and flow of building projects, which is crucial for managing initial high expenditures and income fluctuations. Progress draw features allow contractors to access funds incrementally as project milestones are completed, ensuring a consistent cash flow throughout the construction process. This financial tool is vital for construction entrepreneurs looking to effectively manage finances and sustain business operations in a demanding industry. Additionally, these loans come in various forms, including construction loans, lines of credit, equipment financing, and business expansion loans, each providing targeted support to enhance project execution, financial planning, and business growth within the sector. To secure a contractor loan, one must meet qualification criteria set by lenders, which typically involve demonstrating financial stability, a robust credit history, solid business revenue, and profitability. Building a rapport with financial institutions and presenting a detailed business plan can further enhance eligibility and approval odds for these loans, which can be accessed at advantageous rates and terms by comparing options from different lenders and leveraging established banking relationships.

Contractor loans serve as a pivotal financial tool, enabling construction professionals to manage cash flow, fund projects, and expand their operations. This article delves into the intricacies of these specialized loans, exploring their types, how they’re utilized, and the qualification criteria that determine eligibility. Whether you’re seeking financing for equipment purchases, material costs, or project expenses, understanding the nuances of contractor loans is crucial. We’ll guide you through the landscape of available options, highlighting strategies to secure favorable rates and terms that align with your business objectives. By leveraging the insights provided, you can navigate the world of contractor loans with confidence and ensure your construction endeavors flourish.

- Understanding Contractor Loans: A Financial Lifeline for Construction Professionals

- The Varieties of Contractor Loans Available and Their Specific Use Cases

- Qualification Criteria and How to Improve Your Chances of Approval for a Contractor Loan

- Navigating the Best Rates and Terms: Tips for Securing Favorable Contractor Financing

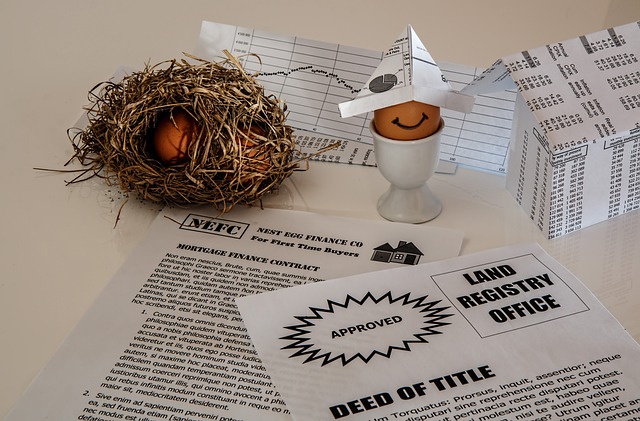

Understanding Contractor Loans: A Financial Lifeline for Construction Professionals

Contractor loans are specialized financial products designed to meet the unique cash flow needs of construction professionals. These loans provide a vital source of funding that can cover various project expenses, from material purchases to labor costs. Understanding the intricacies of contractor loans is essential for construction entrepreneurs who often face the challenge of managing large-scale projects with significant upfront costs and irregular income streams. Unlike traditional business loans, contractor loans are structured to accommodate the cyclical nature of the construction industry, offering flexible repayment terms that align with project completion timelines. This flexibility is crucial for contractors who need to manage cash flow effectively to maintain operations and take on new projects. Additionally, these loans can be tailored to include progress draw options, which allow contractors to withdraw funds as different stages of the construction project are completed. This feature helps ensure that contractors have the necessary working capital throughout the lifecycle of their projects, thereby safeguarding their financial stability and enabling them to focus on delivering high-quality work without the constraint of immediate liquidity.

The Varieties of Contractor Loans Available and Their Specific Use Cases

Contractor loans are specialized financial products designed to meet the unique needs of construction professionals and firms. These loans are tailored to provide the necessary capital for various aspects of contracting work, from equipment purchases to funding projects or covering operational expenses. One prevalent type is the construction loan, which offers funds specifically for building projects, allowing contractors to manage project costs effectively. Another variant, the line of credit, provides a flexible source of funding that can be accessed as needed throughout a project’s duration. This is particularly beneficial for contractors who require ongoing financial support to handle the dynamic nature of their work.

Furthermore, there are specialized loan products for purchasing or leasing equipment, which are crucial for maintaining efficient operations and staying competitive in the industry. Additionally, business expansion loans help contractors looking to grow their operations by financing new projects, hiring additional staff, or acquiring other businesses. Each of these loan varieties serves a distinct purpose within the contracting sector, facilitating smoother project execution, financial planning, and overall business growth. Contractors can select the most appropriate loan type based on their specific requirements and the nature of their current or upcoming projects.

Qualification Criteria and How to Improve Your Chances of Approval for a Contractor Loan

Securing a contractor loan often hinges on meeting specific qualification criteria, which can vary among lenders but typically include a combination of factors that demonstrate financial stability and the ability to manage project timelines. Lenders assess applicants based on credit history, which should be in good standing with few delinquencies or defaults; business revenue and profitability; and personal income if operating as a sole proprietor or partnership. To improve your chances of approval for a contractor loan, it’s advisable to maintain a strong credit score by consistently paying bills on time. Additionally, keeping detailed records of financial transactions, including both income and expenses, can provide a clearer picture of your business’s financial health to lenders. Demonstrating a consistent track record of work and stable cash flow through tax returns and accounting statements will also strengthen your application. Further, establishing a relationship with a bank or credit union can be beneficial; borrowers who have existing accounts may find it easier to secure financing due to a pre-established trust and understanding of the applicant’s business operations. Lastly, ensuring that your business plan is comprehensive and includes clear project outlines, as well as projections for future growth, will further enhance your eligibility for contractor loans.

Navigating the Best Rates and Terms: Tips for Securing Favorable Contractor Financing

When seeking financing for contracting projects, contractor loans play a pivotal role in securing the best rates and terms. To navigate this financial landscape effectively, it’s crucial to approach lenders with a comprehensive understanding of your credit standing and business model. Lenders often assess various factors, including the length of your professional history, the types of contracts you undertake, and the cash flow projections for your projects. By preparing detailed business plans and maintaining robust financial records, you can demonstrate to potential lenders your capacity to manage and repay a loan. This preparation not only enhances your credibility but also positions you favorably to negotiate better rates and terms that align with your project’s requirements. Additionally, exploring a variety of financing options—such as traditional bank loans, SBA-backed loans, or alternative funding sources—can lead to more advantageous conditions for contractors. By shopping around and comparing the APRs, fees, and repayment schedules of various lenders, you can select a loan that offers both competitive rates and terms that accommodate the cyclical nature of construction work. Keep in mind that maintaining a strong relationship with your bank or financial institution can also pave the way for better financing options in the future, as lenders are more likely to offer favorable terms to trusted clients with a proven track record.

In conclusion, contractor loans serve as a vital financial tool for construction professionals, enabling them to manage cash flow and capitalize on opportunities that arise within the industry. With an array of loan options designed to cater to specific needs, from project financing to equipment purchases, understanding the varieties available is key to making informed decisions. Prospective borrowers should focus on meeting the qualification criteria and consider strategies to enhance their creditworthiness to increase their approval odds. By carefully evaluating rates and terms, contractors can secure financing that supports their business objectives while fostering growth. When faced with the financial demands of the construction sector, leveraging the right contractor loan is not just beneficial—it’s an indispensable step towards sustained success.